What you need to know

UC offers a range of health plan options to Medicare-eligible employees and retirees and their eligible family members.

All UC Medicare supplement plans protect your and your family’s health and include behavioral health coverage and virtual care options. Your Medicare coverage is primary. All plans also cover the Medicare Part A and Part B deductible in full. The difference among them comes down to things like how much you pay when you get care, how much you pay in paycheck contributions, and whether prescription drug coverage is included.

How it works

See the plan comparison chart [PDF] for more coverage details.

Medicare providers

Medicare is your primary coverage. Your UC coverage is secondary. So you always want to get care from hospitals or doctors who accept Medicare. You have the option to see providers who do not accept Medicare assignment, but your out-of-pocket costs will be higher. Learn more about provider options.

No-cost medicare preventive care

When you see a provider that accepts Medicare, Medicare covers 100% of the cost (no deductible) for annual Medicare-recommended preventive screenings and lab tests based on your age and gender. While Medicare does not cover what you might think of as a physical exam, it does cover certain wellness services focused on keeping you healthy. Here’s a quick look at the types of visits and services Medicare does and does not cover, so you’ll know what services you’re getting — and what you’ll pay. For more information, go to medicare.gov.

Annual Medicare wellness visit

Annual Medicare wellness visit

Your annual Medicare wellness visit can be in person or virtual. Talk with your doctor about the most appropriate setting for your appointment. Medicare covers most telehealth services through video and telephone.

Medicare also covers COVID-19 vaccinations and boosters. COVID-19 PCR tests are covered at no cost to you when ordered by your doctor or other health care provider. (You may have a cost for a doctor’s visit if you receive a COVID-19 test during the visit.) COVID-19 at-home tests are not covered. And flu shots are covered at no cost to you. If you haven’t received a COVID-19 vaccine or flu shot yet, talk to your doctor about the safety and effectiveness of the vaccine. Your doctor should have the latest guidelines.

If you’re new to Medicare (Part B)

If you’re new to Medicare (Part B)

What’s included in this visit?

Although this is often referred to as a physical exam, the purpose is actually to create a personalized plan and checklist for you. It may not include some of the services you received before you enrolled in Medicare, but it does include:

- A review of your medical history and your health-related social history

- Counseling about and recommendations for preventive services, screenings and immunizations

- Height, weight and blood pressure measurements

- A calculation of your body mass index (BMI)

- A simple vision test

- A review of your potential risk for depression and your level of safety

- Referrals for other care, if needed

Does Medicare cover it?

Yes. However, if your doctor recommends other screenings or tests, such as an EKG, you may have out-of-pocket costs, such as coinsurance (what you pay for covered health care services after Medicare and/or insurance pays its share).

How often can I receive this service?

Once, within your first 12 months of enrollment in Medicare Part B.

If you’ve been a Medicare member 12+ months

If you’ve been a Medicare member 12+ months

What’s included in this visit?

During your visit,* your provider will:

- Develop or update your personalized prevention plan/checklist

- Conduct a health risk assessment

- Create/update a list of your current health care providers and medications

- Take height, weight, blood pressure and other routine measurements

- Discuss your screening schedule (checklist) for appropriate preventive services

Does Medicare cover it?

Yes. However, if your doctor recommends other screenings or tests, such as an EKG, you may have out-of-pocket costs, such as coinsurance (what you pay for covered health care services after Medicare and/or insurance pays its share).

How often can I receive this service?

Yearly, after you’ve been enrolled in Medicare Part B for longer than 12 months.

What else should I know?

You must be enrolled in Medicare Part B. You don’t need to have participated in the “Welcome to Medicare” visit to receive your yearly “Wellness” visit.

*You may not receive some of the services you received during annual physical exams before you enrolled in Medicare.

Ongoing preventive care

Ongoing preventive care

What’s included in this visit?

Services that help you stay healthy by preventing certain illnesses and health conditions, including:

- Screenings for diabetes, cardiovascular disease, depression, colorectal and lung cancer

- Mammograms

- Healthy weight counseling

Does Medicare cover it?

Yes. Medicare generally covers 100% of recommended preventive services. Check the Medicare.gov website for coverage information about specific preventive services.

How often can I receive this service?

Depends on the service. Check Medicare.gov for details.

What else should I know?

For a preventive service to be covered by Medicare, you must meet age, gender and sometimes other Medicare requirements. Check Medicare.gov for more information.

Coverage of physical exams

Coverage of physical exams

What’s included in this visit?

A physical exam and/or tests that do not directly treat an illness.

A test or screening your doctor performs during a physical exam might not be covered by Medicare as a preventive service. Before getting any recommended tests or screenings, check the Medicare.gov website for details about coverage information.

Does Medicare cover it?

No. Medicare does not cover what is traditionally known as a “physical exam.” But you can still get one and pay the full cost for the visit.

How often can I receive this service?

As often as you want. However, Medicare will likely not cover the visit.

What else should I know?

Services not covered by Medicare aren’t covered by UC either, meaning you’ll pay out of pocket for this visit. Be sure this is the visit you want before scheduling your appointment.

What you pay for care

Deductible

The plan covers the deductible for Medicare Part A and Part B in full. If you’re using services covered by Benefits Beyond Medicare, there is a $100 deductible per individual.

Covered care

For other Medicare-covered services, UC generally covers 80% of the remaining in-network expenses after Medicare pays its share. Here’s what you pay.

- Physician and specialist office visits, outpatient X-rays, pathology and lab: 20% of Medicare-approved amount after Medicare first pays its share.

- Virtual care (LiveHealth Online): $20 copay per visit. Medical plan deductible does not apply. Copay counts toward out-of-pocket maximum.

- Outpatient surgery in a hospital or ambulatory surgical center: 20% of Medicare-approved amount after Medicare first pays its share.

- Inpatient non-emergency facility services, emergency room services, and ambulance for emergency or authorized transport: 20% of Medicare-approved amount after Medicare first pays its share.

Out-of-pocket maximum

This limits the amount you’ll pay for covered services during the year. After you meet the out-of-pocket maximum of $1,500 per covered person (which includes the deductible), you get 100% coverage for covered medical services for the remainder of the year. (There is a separate prescription drug out-of-pocket maximum.)

Benefits Beyond Medicare

What’s included

- Virtual visits with a doctor or therapist through LiveHealth Online (no deductible)

- Behavioral health office visits from providers who opt out of Medicare (do not participate in Medicare or do not accept Medicare payment for services)

- Inpatient hospital care beyond Medicare limits

- Acupuncture (Note: Some acupuncture services may be covered by Medicare. For details, see the Medicare and You handbook at Medicare.gov.)

- Hearing aids

- Care when you travel outside the U.S.

- Certain travel immunizations

- Skilled nursing facility care beyond Medicare limits

- Transgender surgery

Except for LiveHealth Online visits, you’ll pay your medical plan’s annual deductible for Benefits Beyond Medicare services. After you meet the deductible, the plan covers 80% of allowable charges.2 You can keep your out-of-pocket costs as low as possible by using Anthem contracted providers. Find Anthem providers by logging onto your Anthem member portal. (On your first visit, you’ll need to register.) If you see a non-contracted provider, you are responsible for paying any amount over the Anthem-allowed amount, which does not count toward the plan’s out-of-pocket maximum.

1. Services must be medically necessary as determined by Anthem to be covered after Medicare limits are reached.

2. The calendar-year deductible does not apply to LiveHealth Online services. However, the $20 copay will count toward the plan’s out-of-pocket maximum.

COVID-19 vaccines, tests and treatment

See below for coverage and costs:

- COVID-19 vaccines and boosters: Covered at 100% by Medicare.

- COVID-19 PCR tests: Covered at no cost to you when ordered by your doctor or other health care provider. You may have a cost for a doctor’s visit if you receive a COVID-19 test during the visit.

- COVID-19 at-home tests: Medicare members will no longer receive free at-home tests.

- COVID-19 treatment: Oral antivirals (e.g., Paxlovid and Lagevrio) covered under Medicare Part D. You pay a portion of the cost once the federal supply of oral antivirals runs out.

- Telehealth (virtual care and video visits): Your Benefits Beyond Medicare coverage includes medical and mental telehealth and video visits through LiveHealth Online.

Source: cms.gov

Behavioral health

You and your covered family members can use behavioral health benefits for sessions with counselors, psychologists or psychiatrists for mental health services and substance use treatment. If you need immediate help, call the Anthem Behavioral Health Resource Center, available 24/7 at (844) 792-5141. You can also speak to a therapist or psychologist virtually through LiveHealth Online.

Prescription drugs

Your prescription drug benefit includes coverage for medications on the Part D formulary, plus additional drugs not covered by Medicare Part D, called over-the-counter drugs.

You can view the formulary, preview drug costs and search for pharmacies on the Navitus portal. For personalized information about coverage and claims, log into the Navitus member portal.

Preferred pharmacies (UC pharmacies, Costco, CVS, Safeway/Vons, Walgreens, Walmart): Sign in to the Navitus member portal to view the complete list of network pharmacies and find a pharmacy near you.

- Tier 1 (preferred generic): $15 (30-day supply); $30 (31–90-day supply)

- Tier 2 (preferred brand): $35 (30-day supply); $70 (31–90-day supply)

- Tier 3 (non-preferred): $50 (30-day supply); $100 (31–90-day supply)

- Tier 4 (specialty): $35 (maximum 30-day supply)

Participating pharmacies (all other Navitus in-network pharmacies):

- Tier 1 (preferred generic): $15 (30-day supply); $30 (31–60-day supply); $45 (61–90-day supply)

- Tier 2 (preferred brand): $35 (30-day supply); $70 (31–60-day supply); $105 (61–90-day supply);

- Tier 3 (non-preferred): $50 (30-day supply); $100 (31–60-day supply); $150 (61–90-day supply)

- Tier 4 (specialty products): $35 (30-day supply)

Mail order: Fill up to a 90-day supply of maintenance medications (those taken on an ongoing basis to treat chronic conditions like asthma, diabetes, high blood pressure and high cholesterol) through the Costco Mail Order Pharmacy. Start a new prescription and request refills online or use the mail order form [PDF], and your prescription will be delivered to you by mail. Learn more about how to order through mail order [PDF].

- Tier 1 (preferred generic): $30

- Tier 2 (preferred brand): $70

- Tier 3 (non-preferred): $100

- Tier 4 (specialty): $35 (30-day supply)

Dispense as written (DAW) penalty: If you or your doctor writes a prescription for a brand-name drug for which there is generic equivalent on the Medicare Part D formulary, you will pay the applicable brand-name (tier 2 or 3) copay plus the difference in cost between the brand-name and the generic equivalent. Your total cost will not exceed the full cost of the brand-name medication. Exceptions for medical necessity can be made with prior authorization from Navitus.

Select generic drugs: No-cost generic drugs used to treat certain chronic conditions, including diabetes, hypertension and high cholesterol — with zero out-of-pocket expense to you at any in-network retail pharmacy or the Costco Mail Order Pharmacy. For a list of covered drugs, see the Navitus MedicareRx formulary or call Navitus MedicareRx Customer Care toll-free at (833) 837-4309. TTY users can call 711.

Over-the-counter drugs: Coverage for medications that are often excluded from Part D coverage, including prescription medications for cough and cold, vitamins and minerals, and lifestyle drugs, including those used to treat erectile dysfunction (ED). Over-the-counter drugs do not count toward your true out-of-pocket expenses. For a list of covered drugs, see the Navitus MedicareRx formulary or call Navitus MedicareRx Customer Care toll-free at (833) 837-4309. TTY users can call 711.

Specialty medications: Lumicera Health Services is the preferred pharmacy for specialty medications — higher-cost prescription drugs used to treat complex conditions and that generally require special handling and storage. Just visit Lumicera online or call (855) 847-3553 to get started. Lumicera offers free delivery to your home or other locations. Specialty medications administered in your doctor’s office (e.g., Botox) may be covered under your medical benefit (through CVS Specialty pharmacy). Call Anthem Health Guide toll-free at (844) 437-0486 for information about actions you or your doctor needs to take. Certain UC pharmacies also dispense specialty medications. You can also work with your provider to order specialty medications through these pharmacies.

Prescription drug out-of-pocket maximum: For 2025 Medicare Part D has a $2,000 out-of-pocket maximum (known as the “true out-of-pocket maximum,” or TrOOP) for Medicare Part D prescription drugs. This is the most you will pay for covered Medicare Part D prescriptions in 2025. The TrOOP is separate from (and does not count toward) the medical out-of-pocket maximum and does not include drugs that are not covered under Medicare Part D. After you meet the TrOOP, you get 100% coverage for Medicare Part D-covered prescription drugs for the remainder of the year.

Coverage restrictions: Some covered drugs may have additional requirements or limits on coverage. For more details, see the Navitus MedicareRx formulary.

- Prior authorization: Generally, your doctor must show that a particular drug is medically necessary. You and your physician will need to get approval from Navitus MedicareRx before the prescription can be filled. Log in to the Navitus member portal to learn more about prior authorization.

- Quantity limits: For certain drugs, Navitus MedicareRx limits the amount of the drug that it will cover. For example, Imitrex (used to treat migraines) is limited to 18 tablets per prescription.

- Step therapy: In some cases, Navitus MedicareRx requires you to first try certain drugs to treat your medical condition before it will cover another drug for that condition.

- Prescriptions filled outside the U.S.: Medicare doesn’t cover outpatient prescription drugs filled by pharmacies outside the U.S. However, they are covered in full (after any applicable copay) through your Navitus MedicareRx plan (specific rules apply). Learn more about prescription coverage outside the U.S.

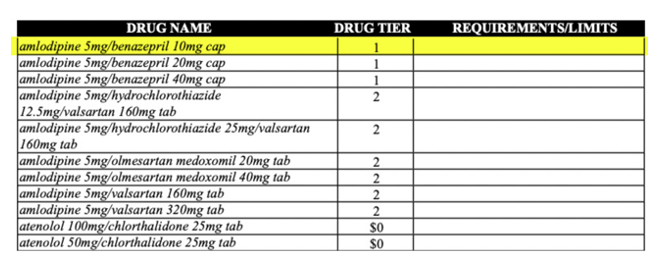

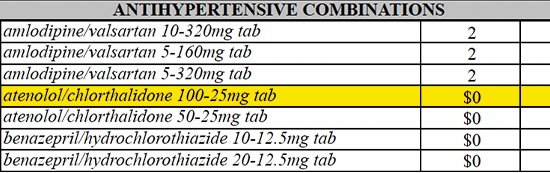

No-cost generic drugs

No-cost generic drugs

Your UC pharmacy benefits include no-cost generic drugs used to treat some of the most commonly prescribed conditions, including diabetes, hypertension and high cholesterol — with zero out-of-pocket expenses to you at any in-network retail or mail-order pharmacy. All select generics have proven track records for effectiveness and value. These medications include drugs such as atenelol and are indicated as $0 on the Navitus MedicareRx Medicare Part D formulary.

Before filling a prescription, find out if the drug is covered. A quick search of the Navitus MedicareRx Medicare Part D formulary will tell you. If the drug the doctor recommends isn’t listed, you can look for alternatives in real time. If you don’t see the drug on the formulary, you or your doctor can contact Navitus MedicareRx Customer Care at (833) 837-4309 for help.

What is a formulary

What is a formulary

A formulary is an extensive list of safe, effective medications covered by a health plan. Every pharmacy benefit manager (Navitus MedicareRx, for the UC PPO plans) uses its own formulary, and it changes over time as new drugs enter the market and brand-name patents expire. Generally, if drugs aren’t on the formulary, they aren’t covered by the plan.

The Navitus MedicareRx Medicare Part D formulary is divided into four tiers (alphabetical list starting on page 115). The lowest-cost drugs (mostly generic) are in Tier 1. The highest-cost medications are in Tier 4 (specialty).

What does this look like?

Say you are newly diagnosed with high blood pressure and your doctor prescribes amlodipine to treat it. The formulary shows amlodipine is in Tier 1, so you know what you’ll pay.

The formulary also will show if any restrictions and rules apply, such as quantity limits.

View your costs

View your coverage, preview drug costs, search for pharmacies, see your benefits, and view the Navitus MedicareRx Medicare Part D formulary on the Navitus portal.

2025 formulary updates

2025 formulary updates

Each month, the Centers for Medicare and Medicaid Services (CMS) changes the Medicare Part D prescription drug formulary. Updates are shown below. See the Navitus MedicareRx Medicare Part D formulary (alphabetical list starting on page 115) for more details about your Medicare and Navitus prescription drug coverage.

February 2025

| Drug Name | Change Type |

|---|---|

| SIMLANDI INJ | Add to specialty tier |

| ADALIMUMAB-AATY INJ | Add to specialty tier |

| ADALIMUMAB-AATY SYRINGE | Add to specialty tier |

2024 formulary updates

2024 formulary updates

Each month, the Centers for Medicare and Medicaid Services (CMS) changes the Medicare Part D prescription drug formulary. Updates are shown below. See the Navitus MedicareRx Medicare Part D formulary (alphabetical list starting on page 115) for more details about your Medicare and Navitus prescription drug coverage.

August 2024

| Drug Name | Change Type |

|---|---|

| BETASERON INJ | Add to specialty tier |

Tips for ordering diabetic supplies

Tips for ordering diabetic supplies

Medicare Part B is your primary insurance for diabetic supplies

Like other Medicare-covered services, Medicare pays first (through Part B), then your UC PPO plan benefits generally pay the rest of the cost.*

1. Confirm your pharmacy will bill Medicare Part B

While most large retail pharmacies can bill Medicare Part B, there are some exceptions.

Before filling a prescription:

- Call the pharmacy and ask “Are you enrolled in Medicare?,” “Do you accept Medicare assignment,” and “Can you bill Medicare Part B for diabetic supplies?” If not, choose a different network pharmacy.

- Confirm your chosen pharmacy is in the Navitus MedicareRx network. Log on to the Navitus member portal or call Navitus MedicareRx Customer Care at (833) 837-4309, available 24 hours a day, 7 days a week, except Thanksgiving and Christmas Day.

2. Submit your prescription

If you are ordering supplies within Medicare standard limits (see If You Need Large Quantities), either you or your doctor can send the prescription for your diabetic supplies to the pharmacy.

If you are dropping off the prescription, ask the pharmacy to first bill Medicare Part B and then submit a claim to Navitus MedicareRx for secondary payment.

If you need large quantities

Requests within Medicare's monthly allowed limits (300 strips and lancets every 3 months for insulin users, 100 for non-insulin users) can be filled with just a doctor's prescription.

If you need a larger quantity, ask your doctor to call Noridian’s Medicare “Medical Provider Line” at (855) 609-9960. Your doctor will need to submit documentation that includes:

- Your bloodwork readings that verify your diabetes diagnosis

- An explanation for why a larger quantity is required

- Confirmation that you know how to test at home

- Confirmation that you are seeing your provider every six months

This documentation is typically needed only for the initial prescription fill.

Once approved by Medicare, your doctor will need to send the prescription and documentation to the pharmacy. Your pharmacy will need to forward both your doctor’s statement and prescription to Medicare.

*Your UC pharmacy benefit plan pays through the Navitus WRAP/Extra Covered Drug (ECD) benefit, not the Part D benefit.

Care outside the U.S.

Access to providers for emergency and non-emergency care through the BlueCard® or Blue Cross Blue Shield Global Core network. You pay 20% of Anthem-allowed amount after the deductible.

Filing claims

Medical and behavioral health

When you see in-network providers for Benefits Beyond Medicare services, there are no claim forms to fill out. Your provider handles all the paperwork. If you see an out-of-network provider, it's up to you to submit a claim for reimbursement for services received. The easiest way to file an out-of-network claim for medical and behavioral health services is through the Anthem member portal.

Pharmacy

When you fill prescriptions at Navitus network pharmacies, there are no claim forms to fill out. Your pharmacy handles all the paperwork.

If you use an out-of-network pharmacy, it's up to you to submit a claim for reimbursement for services received or prescriptions. File out-of-network pharmacy claims through the Navitus member portal.

Get help

For questions about medical coverage, claims, finding providers and more, call Anthem Health Guide at (844) 437-0486 (Monday through Friday, 8 a.m. to 6 p.m. PT) or visit the Anthem member portal.

For questions about prescription drug coverage and costs, call Navitus Customer Care at (833) 837-4309 or visit the Navitus member portal.

Anthem Blue Cross Life and Health Insurance Company is the claims administrator for UC PPO Plans. On behalf of Anthem Blue Cross Life and Health Insurance Company, Anthem Blue Cross processes and reviews the medical, pharmacy and behavioral health claims submitted under the plan. Anthem Blue Cross Life and Health Insurance Company is an independent licensee of the Blue Cross Association. Anthem is a registered trademark of Anthem Insurance Companies, Inc. Navitus is an independent company providing pharmacy benefit management services on behalf of the University of California. All plan benefits are provided by the Regents of the University of California. The content on this website provides highlights of your benefits under the UC PPO Plans. The official plan documents and administrative practices will govern in any and all cases.